General

Ventures in Motion | October 2022

How Funding Winter Never Froze The Supply Chain.

How Funding Winter Never Froze The Supply Chain

Last month we spoke about how funding for logistic start-ups have almost doubled from 2020 to 2021. This month we are deep diving into the Venture Capital scene at large, and addressing VC funding winter (not to be confused with the impending winter season) as well as dry powder (not to be confused with the make up).

Funding Winter

Funding winter refers to the difficult fundraising environment for start-ups due to slowing global economy and global market turbulence coupled with the rising interest rates.

Dry Powder

Dry powder refers to the amount committed but unallocated capital a fund has on hand to invest. The dry powder debate is about whether we should be optimistic or pessimistic about our outlook for start-ups. In an economic downturn, cash on hand means more bullets to invest in start-ups at more attractive terms and valuations.

General VC Funding Market Scaling Back

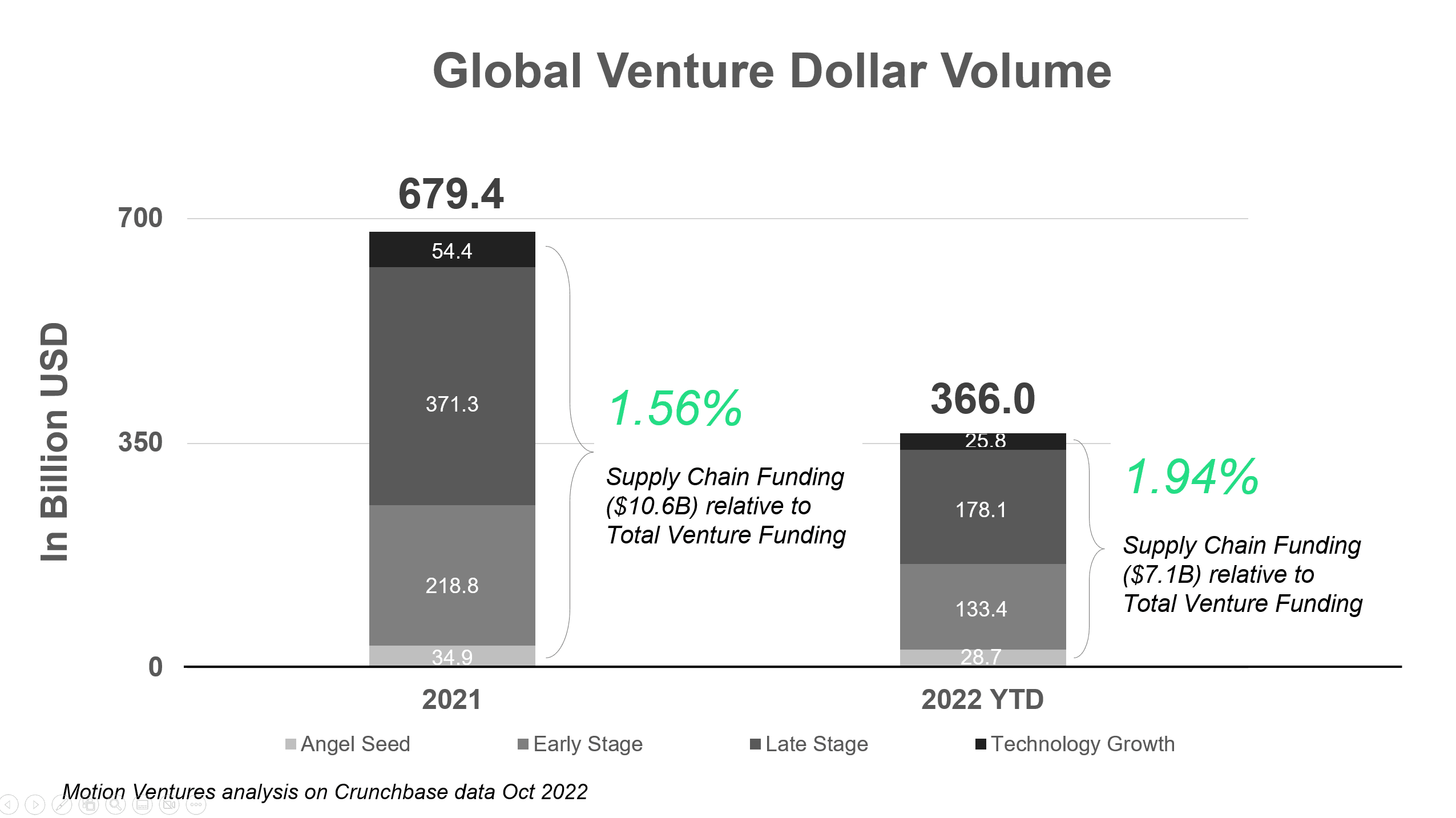

Broadly moving in tandem with the underperforming stock markets, funding in the venture capital space has scaled back the last quarter, with total funding totalling $81 billion compared to last year’s $172 billion - down by $90 billion (53%) year on year according to Crunchbase.

Global venture capital funding has been on a downward trend in YTD of 2022 and the uncertainties may carry forward into Q4. That said, the funding decline has impacted the seed stage start-ups least relative to the entire venture space.

Supply Chain Venture Funding Increased Relative to Rest of Market

At the same time, in the venture funding in Supply Chain has seen a proportional increase relative to total funding market from 1.56% in 2021 to 1.94% in YTD of 2022. This indicates that capital is still allocated to Supply Chain start-ups and innovation to tackle opportunities in the industry.

More than 350+ deals and $7 billion have been closed YTD.

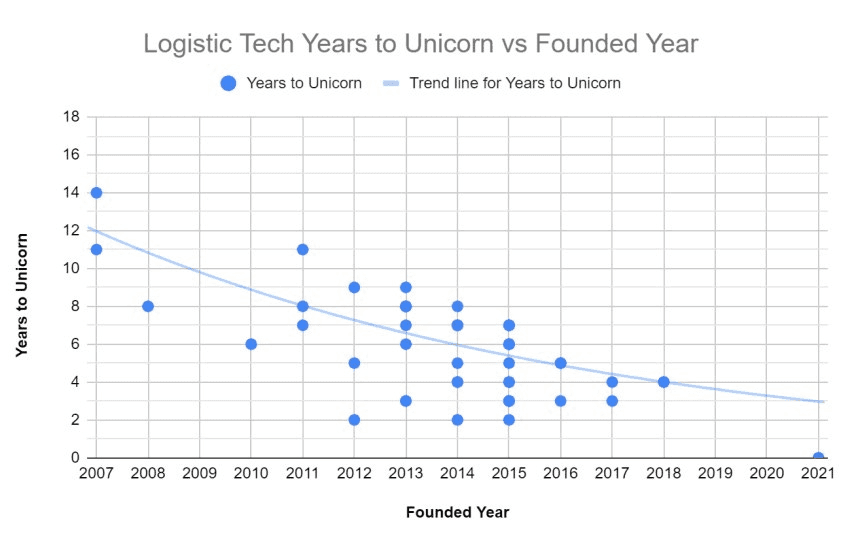

Logistic Tech Years to Unicorn vs Founded Year

Startups in the Logistic Tech space are reaching unicorn status faster than ever.

The term “unicorn” describes startups that are valued at more than $1 Billion. The number of global unicorns soared in 2021 amidst the record year in venture funding and exits. We mapped out 57 Logistic Tech companies on their founding dates versus time taken to attain unicorn status.

This year, a total of 9 logistic startups including Flexe, Motive and Loadsmart achieved unicorn status with the average time taken to become a unicorn was 7 years.

We can see from the graph, the time taken to reach unicorn status is decreasing year by year, bringing the time taken for a startup founded in 2021 to reach unicorn status in an average of 3 years.

Hit reply or comment on our post to let us know your views on the space.

Calling Out

The Pier71 Smart Port Challenge is here! Motion Ventures is eager to see the brightest minds come together collectively to reimagine solutions for maritime, catch us at the final pitch days - mark your calendars for the 18th of November!